Pre-Owned Spotlight: Soft-Market Opportunities That Have Come Back Down In Price — Rolex, Audemars Piguet, And Omega

For today’s edition of Pre-Owned Spotlight, I am looking at watches that represent the softened market. Plenty has been said about the pandemic’s effect on the watch market and the influx of investment buyers. Secondhand prices skyrocketed to a ridiculous zenith in the spring of 2022. But then the bubble burst. Investors suddenly wanted out, and prices steadily fell, leaving watch lovers in uncertainty. This raises some questions today. Is this perhaps the right time to buy? And which watches were prime investor bait and have since seen a hard correction?

Of course, my imaginary crystal ball is just as good as yours, so take the following with a grain of salt. But there are a few cues to go by. Let’s get into it!

Back to pre-pandemic patterns

If we look at ChronoPulse, we see the watch market (or at least a weighted 140-watch representation of it) peak in March of 2022. The index reached 1,840. As I write this, we stand at 1,429. That is a whopping 22% drop overall.

If we zoom out a little to a five-year overview, we see something interesting. From 2019 until the start of 2021, we see a very gradually rising line. Then, at the start of 2021, with the pandemic still going strong, prices start rising more steeply. A year later, in January of 2022, the rise accelerates once more, peaking a mere two months later. This is followed by a steep decline that slowly turns horizontal until today.

But what if we ignore that crazy peak? What if we drew an imaginary line that followed the path of the 2019–2021 period? Interestingly, that leads us only a little bit over where we are today. This is all speculation, but it does seem to support the idea that non-watch-aficionado investors came and left. Perhaps the watch market is coming back to its old self, with its regular players showing regular behavior. Only time will tell. We can already see that the downward trend is slowing down. If my theory is correct, it should transfer back into a very slow and gradual rising trend sometime soon. Now, let’s have a look at some specific watches that saw ridiculous prices and that have subsequently come back down.

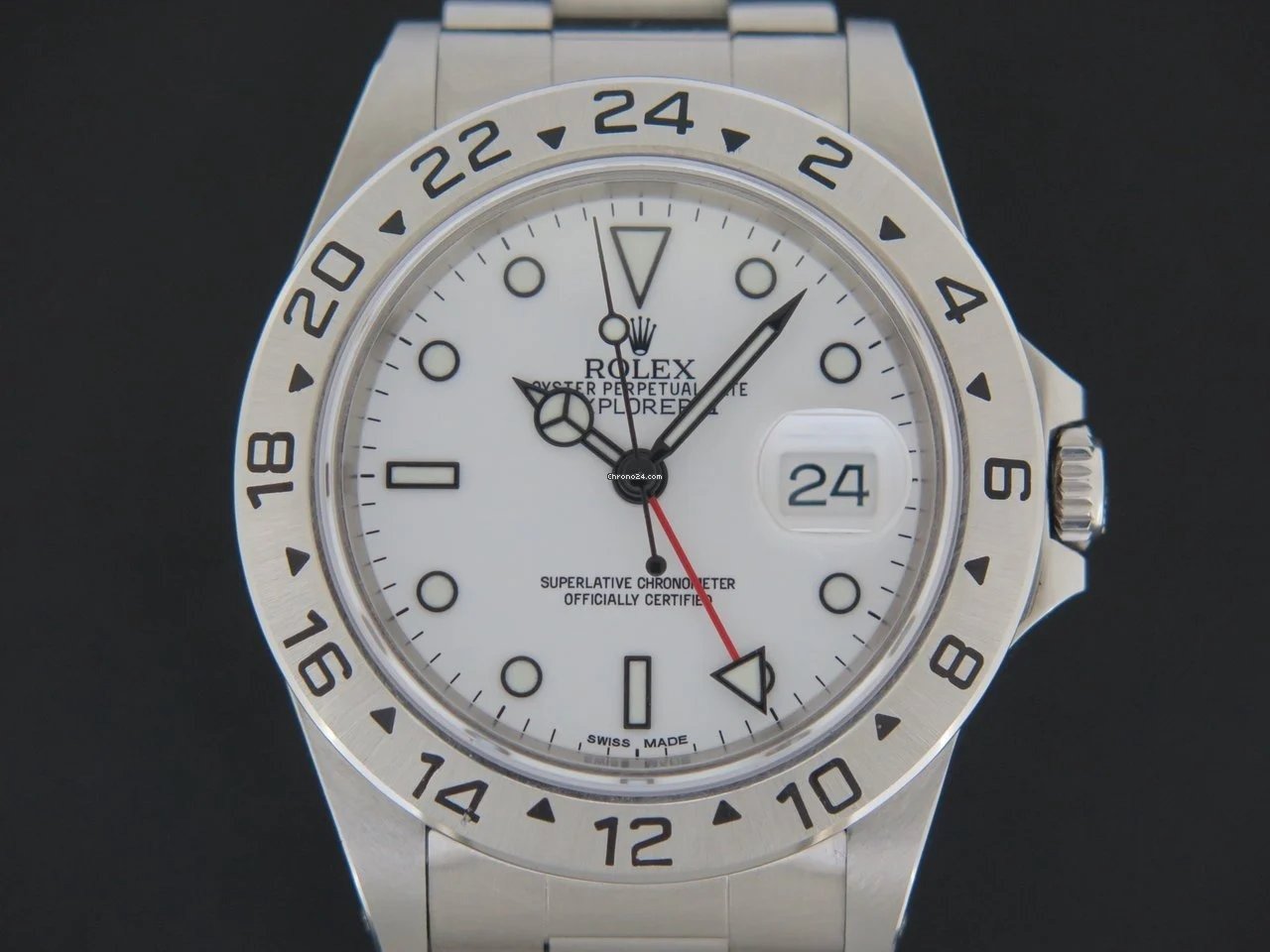

Pre-owned pick #1: Rolex Explorer II ref. 16570

Okay, the first of my pre-owned picks hurts a little for me. Admittedly, I got carried away and feared the Explorer II that I admired so much would grow out of reach. I figured that once it crossed the €10K mark, it would continue to rise into the stratosphere. So I scrambled to get one quickly and succeeded. I succeeded in April 2022, I should add. Ouch.

Still, if you are of a more patient makeup than me, as our own Nacho is, this is pretty great! The Rolex Explorer II ref. 16570 peaked at just around that €10,000 mark. Some good full-set “Polar” (white-dial) versions sold slightly higher still. Today, I have found this neat watch-only example offered in the Netherlands for €7,150.

This one dates back to 1991. Judging from a distance, it seems to have had its dial and handset swapped. They should have had tritium lume in 1991, but these are Super-LumiNova. For me, that would be a deal-breaker. But if you aren’t as picky as I am, it is a chance to snap one up from a dealer with a warranty at around 20–30% less than two years ago.

Pre-owned pick #2: Audemars Piguet Royal Oak ref. 15202ST

Now, let’s move into true trophy-watch territory for the next piece. This category is made up of a small number of grails like the Patek Philippe Nautilus, Rolex Daytona, and Audemars Piguet Royal Oak. It is the category of watches that led the lines in the 2021 surge and the subsequent correction. These are the watches that were prime investor targets.

I have found this 39mm blue-dial Royal Oak ref. 15202ST on offer from a dealer in Germany. This 2021 example comes with the original box and papers and looks to be in good condition. It is priced at an eye-watering €69,100.

But rewind the clock to March of 2022. These traded for a hair under €140,000. In other words, they have lost half their value in two years. However, if we continue the trend from the pre-pandemic years, ignoring the boom, we end up roughly where we are today. So if a Royal Oak is a grail for you, would this be the right time to buy?

Pre-owned pick #3: Omega Seamaster Planet Ocean ref. 2201.50.00

The third and final of my pre-owned picks is an interesting one from Omega. This is the 42mm Planet Ocean 600 ref. 2201.50.00. It comes on a steel bracelet and includes the original box and papers. It is on offer from a Japanese dealer for roughly €3,075 at the time of publishing.

So, why is it interesting? Well, as I described in my earlier overview of the PO collection, I feel these watches are a tad underrated, especially the first generation before they went ever shinier and thicker. The interesting thing is that they did jump in price when the market went up, but then they didn’t come down nearly as much as other watches. In this case, I would argue that the jump up was the correction, not the fall that many watches experienced However, pre-owned Planet Ocean models still represent pretty amazing value in today’s market.

Where else do you find a hardcore dive watch from a top-tier brand for around €3K? Remember, this is Omega’s answer to the Rolex Sea-Dweller. You will have to shell out three to four times as much for one of those from the same era. Even the most desirable Planet Ocean, the transitional ref. 222.30.42.20.01.001, can be had around the €6K–7K mark. These seem to be sleepers in today’s market, and I am quite tempted to snap one up myself.

Closing thoughts

These are interesting times for the watch market. I feel we are approaching a crucial point where we will discover whether we are indeed back to a slow and steady upward trajectory. But, of course, this is judging merely by looking at the past. I haven’t taken into account what unexpected developments lay ahead.

For instance, we predict that quite a few brands are headed for trouble. The absurd increases in retail prices paired with a move to mono-brand stores will undoubtedly affect the secondary market at some point, as will global economic developments.

I am curious to hear your thoughts, Fratelli. Do you feel this is a good time to buy the pre-owned watches that have been on your radar? And will you do so in 2024? Let us know in the comments below!