The Trend Continues: Monobrand Watch Boutiques Are On A Continuous Rise

Do you prefer mono or stereo? And what about quadraphonic or surround sound? I suspect most of you will answer these questions with anything but “mono.” But mono is the trend when it comes to retail in the world of watches. Monobrand watch boutiques are on a continuous rise. As a watch fan, you, more often than before, have to travel to different “worlds” to experience watches from various brands. The experience of comparing similar watches from different brands side by side is under pressure. Brands want you to stay in their bubble and forget about the outside world. How do you feel about that?

Two years ago, I wrote about the rise of monobrand watch boutiques after observing the changes in Amsterdam’s most famous luxury shopping street. The P.C. Hooftstraat is among the top 10 fanciest shopping streets in the world. On this relatively short stretch of pavement, there are monobrand watch stores from Hublot, Chopard, Rolex, Patek Philippe, Breitling, IWC, Panerai, and TAG Heuer, just to name a few. More recently, Vacheron Constantin and Omega each opened a boutique on that street, and the AP House is just around the corner from the P.C. Hooftstraat.

Monobrand watch boutiques are on a continuous rise

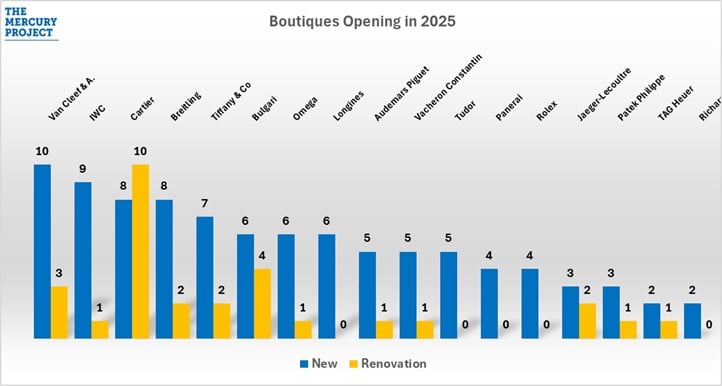

According to The Mercury Project, a Swiss-based data-driven consulting company specializing in the watch and jewelry retail industry, monobrand watch boutiques are on a continuous rise. Despite a challenging retail environment for watches and jewelry in 2025, industry-leading brands continue to invest steadily in new monobrand boutiques and store renovations. A closer examination of these initiatives reveals emerging strategic patterns, both geographically and at the brand level. In 2025, 26 brand-exclusive boutique openings, renovations, and relocations occurred worldwide. These involved 17 major watch and jewelry brands (see the list in the chart above).

Although not an exhaustive analysis, the number of openings and renovations still presents a reliable overview of strategic trends. The numbers show expansion in the retail watch and jewelry sector, driven by experiential luxury, flagship investments, and geographic diversification. It is interesting to see that the brands selling both watches and jewelry are the most active. Cartier is leading the charge with a total of 18 boutiques, including eight openings and 10 major renovations, followed by Van Cleef & Arpels (13 boutiques and 10 openings), Tiffany & Co. (10 boutiques and eight openings), and Bvlgari (10 boutiques and six openings). Most of these openings are flagship stores.

Watch-only worlds

There is also plenty going on in the world of watch-exclusive boutiques. IWC, for example, opened one of nine new brand-only stores in Taichung, Taiwan. Vacheron Constantin relocated its boutique in Seoul, and Jaeger-LeCoultre’s boutique underwent a significant renovation at the Kuala Lumpur Pavilion. Outside Richemont, Breitling had eight new openings, including three in China and one in Enschede, Netherlands.

Despite a new boutique in a relatively small regional Dutch town close to the German border, the USA and Greater China remain core growth hubs, with 24 and 16 openings/renovations, respectively. Interestingly, the US openings are concentrated in secondary markets or resorts, such as Atlanta (Bvlgari), Las Vegas (Cartier, Tudor), Austin (IWC, Panerai, Rolex, TAG Heuer), Aspen (Omega), Dallas (Tudor), or The Hamptons (Rolex). Except for Patek Philippe in San Francisco or Van Cleef & Arpels and Longines in New York City, there were few openings in prime retail destinations.

In Europe, the focus for 2025 is on heritage capitals, including Paris, Milan, Zurich, and London. Major renovations and relocations of flagship stores are reported, with a focus on creating a more premium environment. There is also a trend towards multi-floor stores in historic luxury streets, such as the Rolex boutique on Old Bond Street in London, the Bvlgari and Tiffany & Co. stores on Via Monte Napoleone in Milan, and the Van Cleef & Arpels and Longines monobrand boutiques in Zurich’s Bahnhofstrasse.

Building and shaping

New and redesigned monobrand watch boutiques showcase as many products as possible, including special and limited editions, giving them an edge over multibrand retailers. But what’s also paramount is that the monobrand stores are precisely how the brand in question envisions a retail space. It needs to be one where the consumer can fully experience the brand. The retail space is a crucial tool in conveying the brand message and experience. Good examples are Patek Philippe’s museum-like 3,600-square-foot store in Hong Kong, which also includes a private dining room, and Cartier’s renovated flagship in Miami, which is both an architectural landmark and a boutique. Less ambitious but also trying to create new experiences for customers is IWC’s Big Pilot Café in Bahrain. The current trend in watch retail is not just mono; it also tries to blend luxury retail with different types of lifestyle experiences.

Opening a monobrand boutique doesn’t necessarily guarantee success, though. For instance, Richemont Group closed 14 brand boutiques last year because they didn’t perform as expected.

What will 2026 bring?

The trend of the number of monobrand watch boutiques continuing to rise is not expected to stop in 2026. Flagship stores for Audemars Piguet, Patek Philippe, and Rolex on NYC’s Fifth Avenue and Tiffany & Co. on Rodeo Drive in Beverly Hills are also in the pipeline. There’s also word of the first Rolex and Patek Philippe boutiques on the African continent. Cape Town, South Africa, is rumored to be getting a Patek Philippe boutique, and Rolex has been cited as partnering with local retailers in Johannesburg, Durban, and Cape Town.

Buying watches while traveling will also become easier with Cartier opening a boutique at LAX. And while you’re cruising the high seas in luxurious style, buying a Cartier, IWC, and/or Breitling will also become easier since these brands are increasingly active on these floating palaces.

Your home away from home

The question I ask myself, and you, is this: who enjoys monobrand boutiques in the way they are meant to be? Do you enjoy being in a world where everything is focused on one watch brand? Where everything, from the coasters to the wall decoration, shouts the carefully crafted and curated brand image? Where the message is “come and have a coffee; this is your home away from home,” but you have the feeling that a cappuccino is paid for with a chronograph? And although the complete collection is on display, the only choice you have is between model X with either this or that color dial, not between comparable models from other brands, making it not easier but actually harder to choose.

My answer is this: I’m not so sure a watch fan is sensitive to a store in the perfectly curated theme of the brand. That person doesn’t care too much if there’s a propeller on the wall behind the showcase with pilot’s chronographs. Despite not being a pilot, the watch enthusiast’s eyes are on the pilot’s watch because of its technical capabilities, backstory, and the reputation of its manufacturer. Nevertheless, buying a luxury watch should be a memorable experience. Still, mostly that comes down to having attentive and knowledgeable staff assisting you in the buying process and the opportunity to make a thought-through decision before swiping the card. In the end, it’s the product that will be on your wrist, not the propeller.

Where do you do your watch shopping?

Having said that, a multibrand store is only as good as its collection and staff. The idea of being able to choose between three kindred watches, all from different brands, sounds appealing. Still, what happens when the staff doesn’t know these watches inside and out? And what about staff that will go for the “easy sale,” meaning not taking the time and effort to show you a creation from an upcoming or less famous brand in favor of an established fast mover? This scenario is also far from ideal. Still, if you had to choose, where would you want to go for your watch shopping?