Chrono24 & Fratello: Secondary Watch Market Report H1 2025

Being part of the same group of companies as Chrono24 has its advantages: Fratello has access to the unrivaled data pool and insights of the world’s leading marketplace for luxury watches. With over 9 million monthly users and more than 560,000 listed watches, there is plenty to analyze and learn. We sat down with their data team for a deep-dive into the current state of the secondary watch market, to look at emerging trends, and to put overall brand performances into a long-term perspective. What we found is a stable secondary market driven by the mid-level luxury segment, and Gen Z’s increasing role in setting trends.

In fashion, trends turn fast – the cut, color, or brand that defined yesterday is passé tomorrow. Watches have long appeared immune to such cycles, protected by heritage and evergreen designs. Cartier is a prime example of this with their iconic Tank and Santos collections: Both look back on a century-long history with only minor design changes. Yet even this deliberately paced world moves in eras: the pursuit of ultra-thin, the rise of rugged steel sports models, the age of integrated bracelets. Changes have typically been evolutionary rather than abrupt.

This trend-immunity of the watch industry is being challenged. A new wave of enthusiasts, keen to define their own style, is challenging the long-standing dominance of luxury steel sports icons like the Royal Oak, Submariner, and Speedmaster. These timepieces remain bestsellers by volume, but another category is gathering speed.

Gen Z And Cartier: The Perfect Storm

Enter the dress watch. A category that hasn’t been showered with attention and excitement for a long time is suddenly having its moment: smaller in size, often in gold, paired with a leather strap – and on the wrists of watch influencers and Gen Z watch enthusiasts all over Instagram and TikTok. One of the beneficiaries of this trend is Cartier with their meteoric rise on the primary market, right on the heels of Rolex. Cartier is a brand with an incredibly consistent and strong design language firmly rooted in dressy elegance that has been masterfully perfected over decades.

Even their sportier pieces, like the Santos-Dumont, are unmistakably a result of an overall elegant design system. Unlike rugged steel sports watches, these dressier pieces, specifically those on the vintage side, were flying under the radar of enthusiasts and prices were therefore very attractive. This helps if you are a young professional looking for your first timepiece and a style statement.

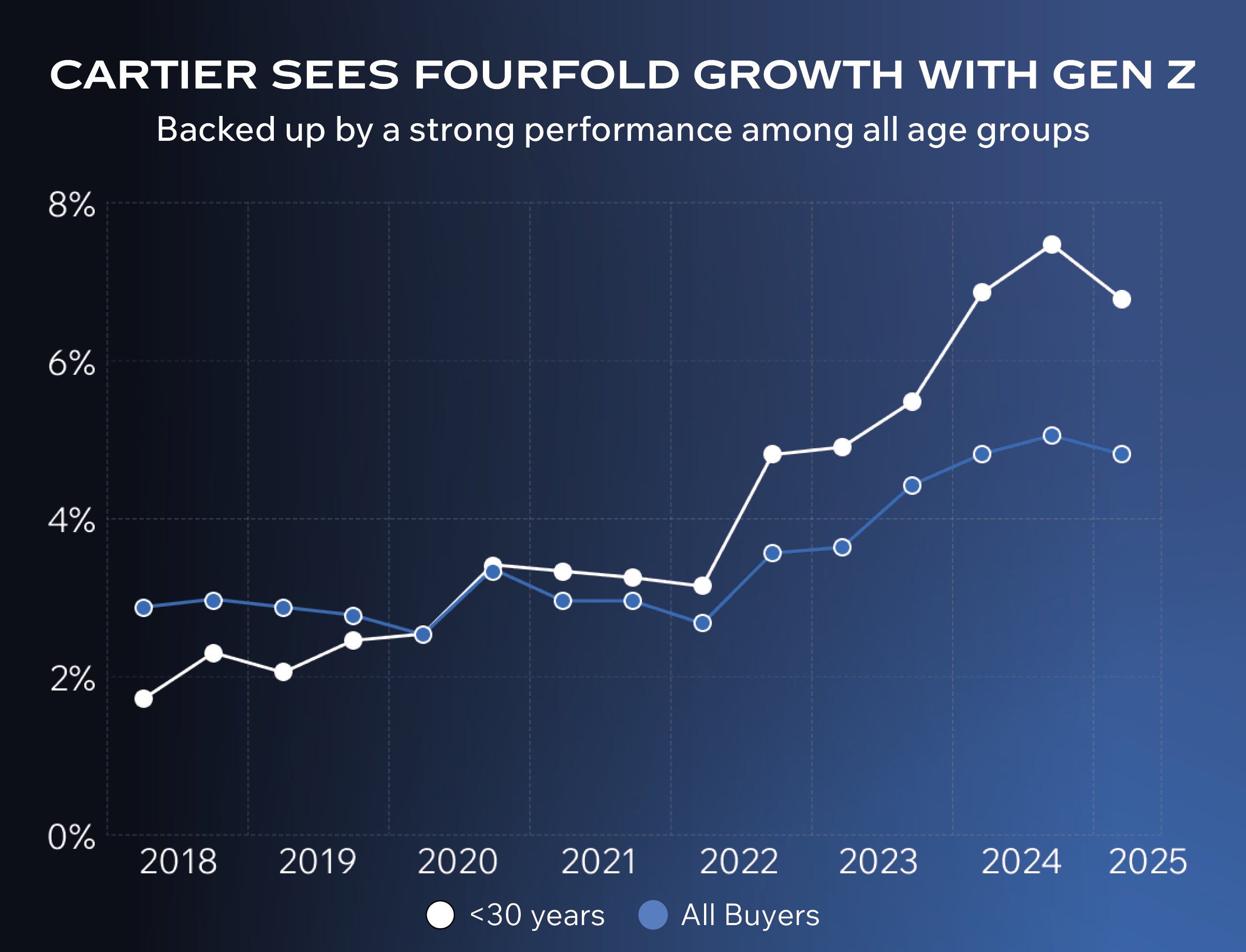

Looking at the Chrono24 data, the trend is astounding: Cartier’s share of total watch sales among Gen Z has increased from 1.7% to 6.8% in a span of seven years – in other words, it has increased more than fourfold. Comparing this to the overall data of all age groups combined, it highlights just how big of a driving force Gen Z is for Cartier: Cartier has “merely” increased by 65% in sales, going from 2.9% to 4.8% across the same timespan.

Dress Watches Are Increasing In Popularity, With Gen Z Spearheading The Trend

If we zoom out further and look at the dress watch category in general, Gen Z remains the trendsetter with the share of dress watch sales increasing by 44% from 2018 to 2025, compared to an average of 29% sales increase among other age groups. 12% of all watches bought today by Gen Z are dress watches, the highest share among all age groups.

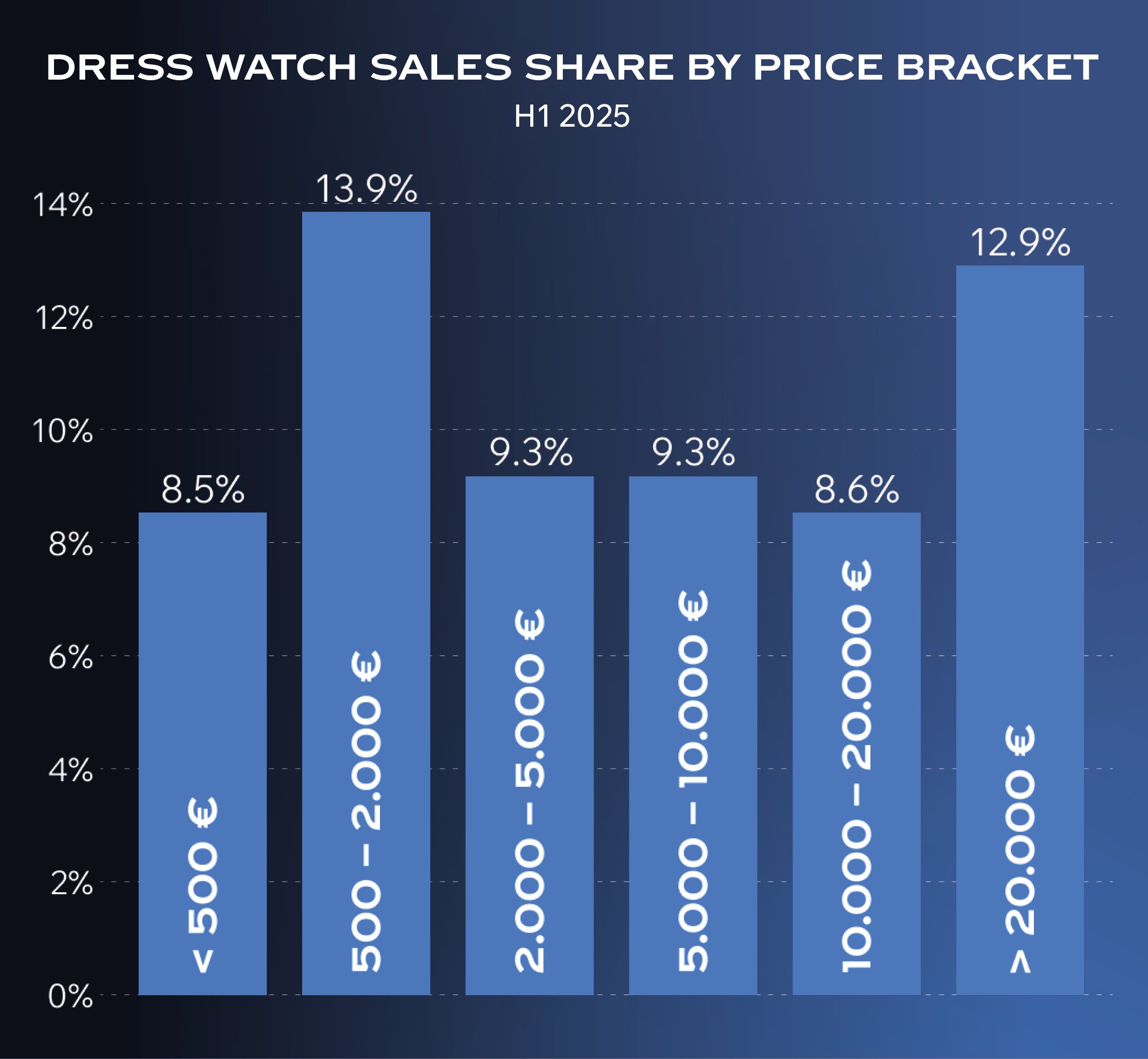

A rather interesting observation that is unique to the dress watch category: A strong tendency has crystallized recently to either buy a basic, entry- level time-piece (500–2,000 €) or an expensive high-end model (>20,000 €). This seems consistent with the observation that pricing can be attractive for vintage pieces and Gen Z’s purchase power gravitates towards this price category. Seasoned collectors, on the other hand, buy a dress watch to really indulge in haute horlogerie.

Is Gen Z’s Hunger For Dressier Watches Already Slowing Down?

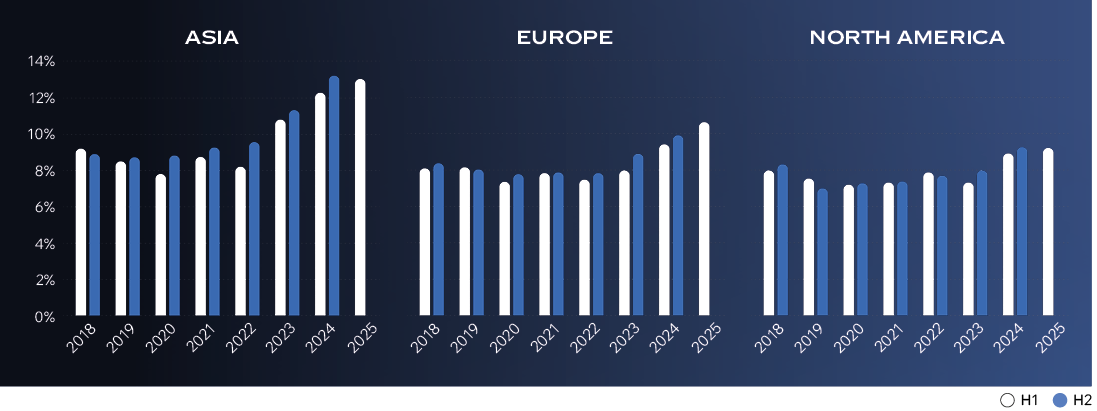

While all of the above sounds like the dress watch trend-train is moving full speed ahead, we have an interesting observation: The massive increase in demand for dress watches started in 2023, yet in H1 2025 it has already seen a very slight dip in Asia and North America. The same is true for secondary market sales of Cartier overall, although their upwards trajectory started a lot earlier. One might start to wonder: Was the dress watch demand an isolated Gen Z phenomenon that didn’t catch on? And is Gen Z already on the lookout for the next trend? Or are we just seeing a temporary dip and the pace will pick up again?

This is a question we will happily address in our upcoming H2 2025 report. But first, let’s have a look at the overall market and brand performances from 2018 to today in general, and H1 2025 in particular.

Overall Secondary Market Insights

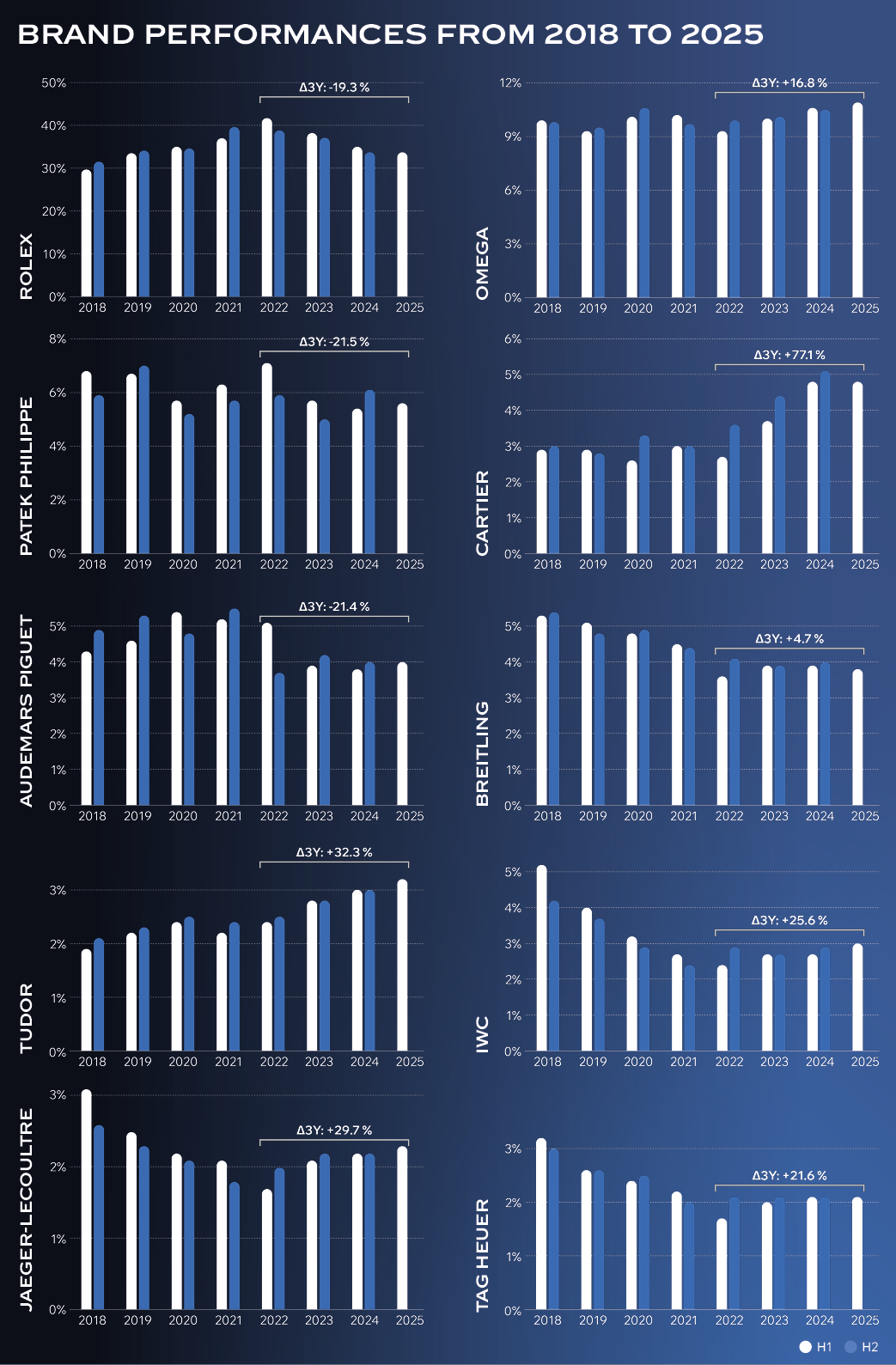

The secondary watch market remains solid and resilient, even as some of the pandemic-era frenzy has cooled. Rolex, which saw unprecedented demand during COVID, has returned to more typical levels, continuing to grow steadily over the long term while anchoring the market. Established key players like Cartier, Jaeger-LeCoultre, and Omega are thriving, gaining traction with a growing base of informed collectors. At the high end, Patek Philippe and Audemars Piguet have moved past speculative peaks, with their most coveted pieces now trading mainly among serious enthusiasts.

Overall, the market shows a healthy mix of stability, shifting market shares, and selective growth. This chapter highlights the top 10 brands, their standout collections, and how the landscape has shifted long term and from 2024 into H1 2025.

Brand Performances From 2018 to 2025

In H1 2025, Rolex continued to show a slight decline in market share, a trend that began in H1 2022. However, the drop has slowed noticeably in recent periods, suggesting the brand is finding an equilibrium. Despite this, Rolex remains the undisputed leader in the watch world, with demand staying exceptionally strong across both new and secondary markets. Many models still have long wait lists at authorized dealers, and allocations for highly sought-after pieces like the stainless-steel Daytona or GMT-Master II “Pepsi” are hard to come by.

Omega holds the second-highest market share of any brand in the secondary watch market, demonstrating steady growth and enduring demand that has even increased in H1 2025. Its performance has remained consistently strong, supported by a loyal collector base and the allure of special editions. Limited runs of select watches like the Speedmaster Silver Snoopy Award trade above retail on the secondary market due to high demand by collectors.

Notable Long-Term Changes

A strong winner in market share has been Cartier, driven by an increasing demand for more classic watches spearheaded by Gen Z, as highlighted in the first part of this report. With iconic and elegant collections such as the Tank and Santos, Cartier’s watches are recognizable and coveted by many. Additionally, there are affordable entry points into the luxurious Cartier brand with vintage and pre-owned models from the Must de Cartier collection. Tudor is another winner that has successfully captured the interest of a young audience. Brands like Breitling and IWC are struggling to benefit in the same way.

On the higher end of the spectrum, Patek Philippe and Audemars Piguet both experienced a tremendous surge in demand on the secondary market during the COVID-19 period, fueled by collectors and investors chasing high-profile timepieces. Since then, the initial hype has faded, and sales have normalized, but both brands continue to show stable performance and multi-year growth. Patek Philippe remains anchored by the enduring Nautilus. Even with the launch of the much anticipated Cubitus model, which generated significant buzz, the Nautilus remains the brand’s cornerstone – a position unlikely to change anytime soon.

Recent Performances in H1 2025

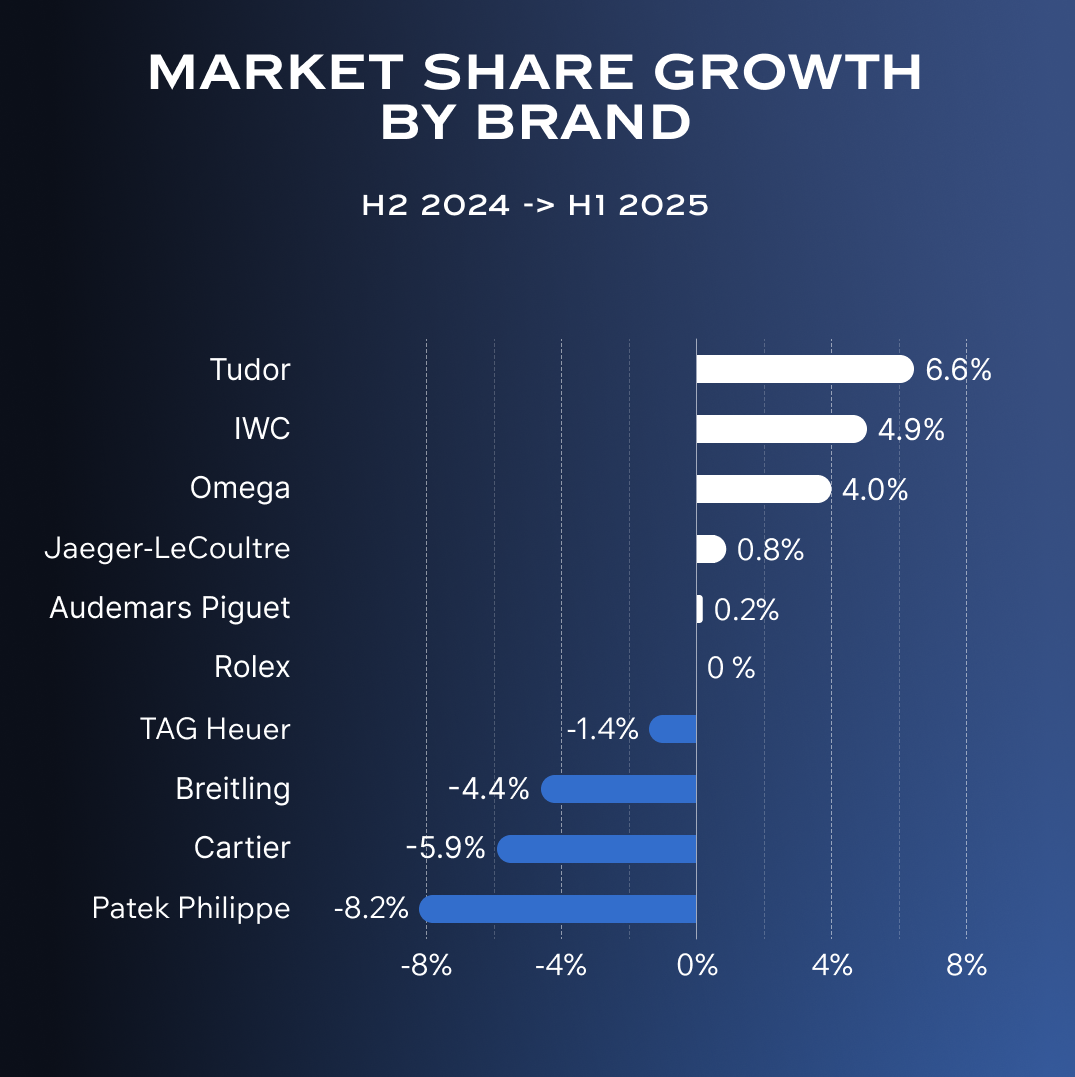

Now, let’s narrow it down and have a look at the performance of the top 10 brands in H1 2025 compared to H2 2024. When looking at relative market shares, Patek Philippe has the biggest change of all brands and a negative one at that: losing 8.2% in market share. However, additional context is valuable here, since H2 2024 was a particularly strong period for Patek Philippe. If we add Audemars Piguet into the picture to represent the wider haute horlogerie segment, the picture becomes clearer: AP is sidestepping with a slight increase of 0.2% – signaling that the segment is stable, yet buyers remain cautious for the time being.

On the other side of the spectrum, Tudor and IWC are showing the strongest increases, both gaining 6.6% and 4.9% respectively. This is particularly great news for IWC, potentially marking a turning point for the brand. The relaunch of the coveted Ingenieur – a watch originally designed by the legendary Gérald Genta – was orchestrated with a strong marketing focus around the F1 movie: It was a brilliant move to showcase the watch on the wrist of Hollywood legend and known watch-aficionado Brad Pitt. Likewise, Tudor’s partnerships with David Beckham and various other sports collaborations keep on resonating with their audience.

Future Trends Under Close Watch

The most intriguing development was the impact Gen Z is having on the dress watch category. However, we already noted a signal that may predict future market direction: While dress watch demand has surged dramatically since 2023, H1 2025 shows the first slight dip in this trend. Whether this represents a temporary pause or a shift in Gen Z‘s interest will be closely monitored in upcoming market analyses.